How Artificial Intelligence Can Be Used in Compliance

Artificial Intelligence (AI) is revolutionizing various industries, and its impact on compliance is no exception. This article explores the benefits of AI for compliance officers in managing regulatory compliance, Anti-Money Laundering (AML) compliance, its impact on compliance programs, and the challenges and opportunities it presents to the industry.

Understanding the Role of AI in Compliance

In an era where technological advancements are reshaping industries, Artificial Intelligence (AI) has become a pivotal element in compliance. AI's ability to analyze large volumes of data and identify patterns makes it an indispensable tool for organizations aiming to meet regulatory standards.

AI in Regulatory Compliance

Ensuring regulatory compliance, especially regulatory change management, is critical to any business. This entails strict adherence to laws, guidelines, and specifications relevant to business processes.

AI significantly eases this burden by automating the monitoring and reporting processes. It can swiftly sift through vast amounts of regulatory content to spot new requirements or updates to manage adherence to regulatory requirements. AI systems can be designed to stay updated with the latest regulatory changes, ensuring businesses remain compliant.

Machine Learning for Compliance

Machine learning, a subset of AI, excels in pattern recognition and anomaly detection, which are crucial in compliance. It can analyze historical data to predict potential compliance risks, enabling proactive risk management. Machine learning algorithms can also learn from new regulatory data, continuously improving their accuracy in identifying compliance issues.

AI Tools for Compliance Officers

Compliance officers can boost efficiency with AI tools, automating routine tasks like data analysis. This allows them to focus on complex compliance issues. AI-driven analytics offer risk insights, improving report accuracy and reducing time/resource requirements. Furthermore, it enhances transparency for regulators and aids employee compliance training through interactive programs.

AI and Risk Management in Compliance

AI plays a crucial role in risk management within compliance. It can predict potential compliance risks and suggest measures to mitigate them. AI systems can monitor real-time transactions, providing alerts on suspicious activities that may indicate non-compliance or fraud. This real-time analysis helps in quick decision-making to prevent compliance breaches.

Implementing AI in Compliance Processes

Integrating Artificial Intelligence (AI) in compliance processes marks a transformative shift in how organizations approach regulatory adherence. AI's advanced algorithms and data-processing capabilities offer unprecedented opportunities for enhancing and streamlining compliance tasks.

AI Use Cases in Compliance Activities

AI has diverse applications in compliance. It can be used for predictive analytics, forecasting potential compliance risks based on historical data. AI also aids in document analysis, quickly scanning and interpreting vast legal and regulatory documents to ensure compliance. Furthermore, AI-driven chatbots can provide interactive and personalized learning experiences to assist compliance training.

Leveraging AI to Address AML Compliance

Anti-Money Laundering (AML) compliance is a critical concern for financial institutions. AI significantly bolsters AML efforts by providing advanced tools for monitoring transactions, identifying suspicious activities, reducing false positives, and conducting due diligence.

AI systems can analyze patterns and trends in financial transactions to flag potential money laundering activities, thus aiding in the early detection and prevention of financial crimes.

Deploying AI for Regulatory Changes Adaptation

Regulatory environments constantly evolve, and AI is crucial in helping organizations adapt to these changes. AI systems can be programmed to stay updated with the latest regulatory requirements, automatically adjusting compliance processes accordingly. This adaptability ensures that organizations remain compliant even as regulations change.

Adoption and Deployment of AI in Compliance

The adoption and deployment of AI in compliance involve strategic planning and investment. Organizations must assess compliance needs and identify areas where AI can bring the most value. This includes evaluating existing compliance processes, training personnel, and ensuring AI systems align with regulatory standards and ethical considerations.

The Impact of AI on Compliance Programs

AI drives compliance programs by providing compliance officers valuable insights and actionable intelligence. Its use enables the automation of compliance processes, supporting decision-making and regulatory adherence with greater precision and speed. Furthermore, it can potentially revolutionize compliance and risk management in the future, paving the way for more advanced and sophisticated compliance practices.

READ: How Artificial Intelligence is Transforming the Business

Benefits and Challenges of AI Adoption in Compliance

Adopting Artificial Intelligence (AI) in compliance brings many benefits but presents specific challenges. This dual aspect is crucial for organizations to understand and navigate as they integrate AI into their compliance strategies. Here, we explore the advantages and hurdles of employing AI in compliance processes.

Benefits of AI Adoption in Compliance

- Enhanced Efficiency and Accuracy: AI significantly speeds up regulatory data processing and analysis, a core component of compliance tasks. This rapid processing and AI's ability to minimize human error leads to more accurate compliance reporting and decision-making.

- Proactive Risk Management: AI's predictive analytics capabilities allow organizations to anticipate potential compliance risks before they materialize. By analyzing trends and patterns in data, AI can identify areas of concern, enabling proactive rather than reactive risk management.

- Cost Reduction: AI can lead to considerable cost savings in compliance operations over time. By automating routine tasks, reducing the need for manual oversight, and improving accuracy, organizations can reduce operational costs related to compliance.

- Adaptability to Regulatory Changes: AI systems can be programmed to stay updated with compliance regulations and standards. This adaptability ensures that organizations can quickly adjust to regulatory changes, maintaining compliance at all times.

- Improved Decision-Making: With AI's comprehensive data analysis, compliance officers can make more informed decisions. AI provides deep insights that might not be evident through manual analysis, leading to better compliance strategies.

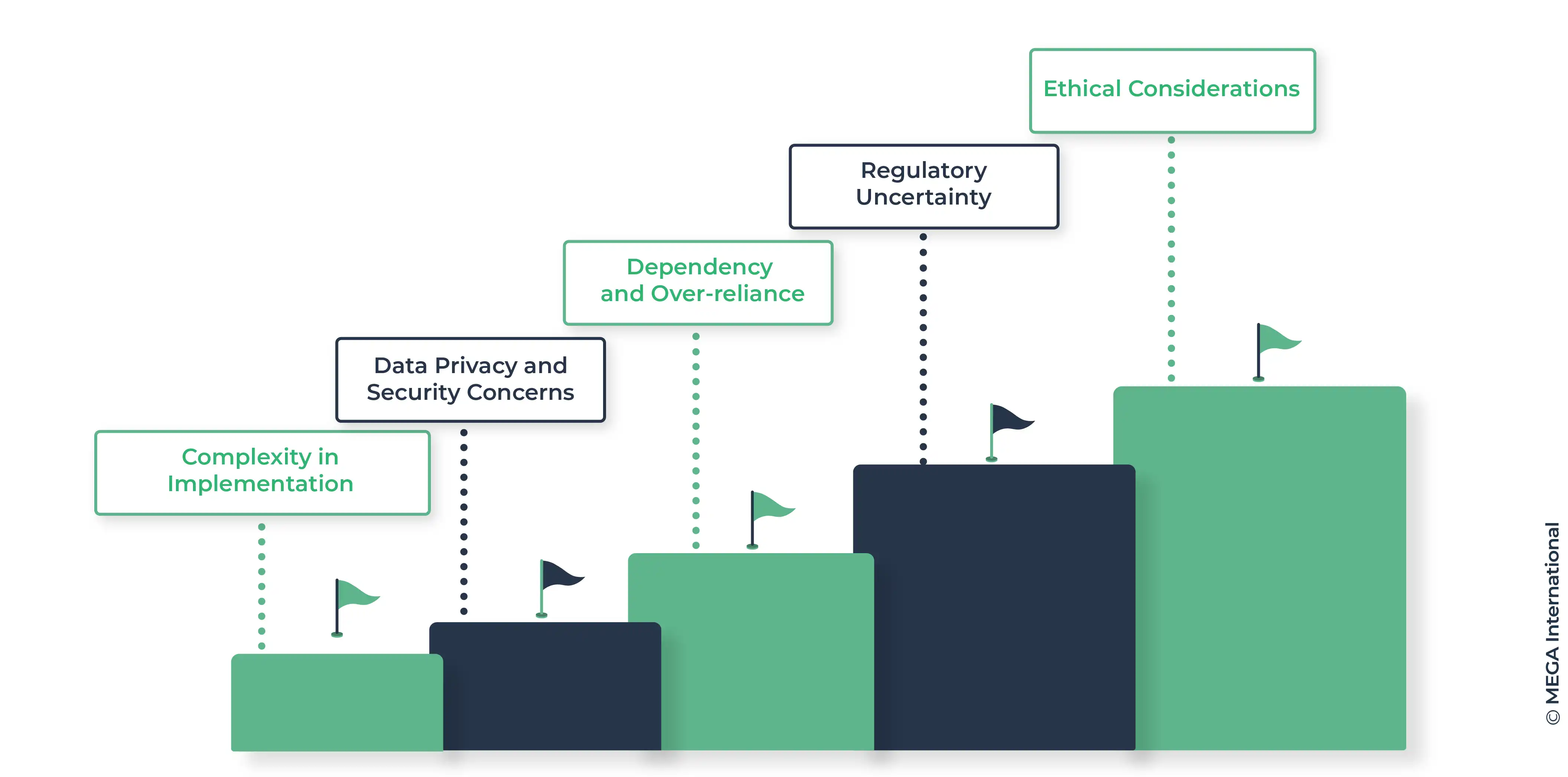

Challenges of AI Adoption in Compliance

- Complexity in Implementation: Integrating AI into compliance frameworks can be complex and resource-intensive. It requires technical expertise, substantial initial investment, and an understanding of how AI can be best utilized within specific compliance contexts.

- Data Privacy and Security Concerns: AI systems rely on vast amounts of data, which raises concerns about data privacy and security. Ensuring that AI complies with data protection regulations is a significant challenge.

- Dependency and Over-reliance: There's a risk of becoming overly reliant on AI for compliance decisions. Maintaining a balance between automated and human decision-making is crucial to ensure that AI complements rather than replaces human judgment.

- Regulatory Uncertainty: AI in compliance is a relatively new field, and regulatory frameworks addressing AI's role in compliance are still evolving. Navigating this uncertain regulatory landscape can be challenging for organizations.

- Ethical Considerations: AI in compliance must adhere to ethical standards, particularly in decisions that might affect customers or employees. Ensuring that AI systems are fair, transparent, and non-discriminatory is crucial.

The Future of AI in Compliance

As businesses and regulatory environments evolve, Artificial Intelligence (AI) 's role in compliance becomes more prominent and sophisticated. The future of AI in compliance points towards a more integrated, intelligent, and proactive approach.

Predictive Compliance Management

AI's future in compliance will likely be defined by its predictive capabilities. AI systems will not only identify existing compliance issues but will also predict future risks. This shift from reactive to proactive compliance management can save organizations from legal and financial pitfalls.

Real-Time Compliance Monitoring

With advancements in AI, real-time monitoring of compliance will become more prevalent. AI systems will continuously analyze transactions, communications, and other business activities to ensure adherence to regulatory requirements. This real-time analysis will enable immediate responses to potential compliance breaches.

Personalized Compliance Solutions

AI is expected to offer more personalized compliance solutions tailored to the specific needs of each organization. By analyzing an organization's unique risk profile and compliance history, AI can provide customized recommendations and strategies for compliance management.

Enhanced Regulatory Intelligence

AI will play a crucial role in regulatory intelligence, automatically gathering and processing regulatory information from various sources. This will include understanding current regulations, forecasting future regulatory trends and changes, and preparing organizations in advance.

Integration with Other Technologies

Integrating AI with emerging technologies like blockchain and the Internet of Things (IoT) will enhance compliance processes. Blockchain can offer secure and transparent record-keeping, while IoT devices can provide real-time data for compliance monitoring, integrated through AI for optimized compliance management.

Addressing Ethical and Privacy Concerns

Addressing ethical and privacy concerns will be a priority as AI becomes more ingrained in compliance. Future developments will need to focus on creating AI systems that are transparent, fair, and compliant with data protection laws, ensuring the ethical use of AI in compliance.

Evolving Role of Compliance Professionals

The role of compliance professionals will evolve with the advancement of AI. Rather than being replaced, they will work alongside AI, focusing on strategy, interpretation, and decision-making aspects of compliance. AI will augment their capabilities, not diminish their importance.

Challenges and Continuous Learning

The future will also bring challenges, particularly in keeping AI systems up-to-date with evolving regulations and ensuring they are free from biases. Continuous learning and adaptation will be critical components of AI systems in compliance.

Summary

The future of AI in compliance is poised for substantial growth and sophistication. While it promises increased efficiency, accuracy, and proactive risk management, it also requires careful navigation of ethical, privacy, and learning challenges. The synergy between AI and human expertise will redefine the landscape of compliance management.

FAQs

Using AI tools and AI models, compliance professionals can leverage artificial intelligence to streamline compliance processes, automate compliance tasks, and identify patterns in large amounts of data to ensure compliance requirements are met.

AI can help in compliance and risk management by managing compliance risks, driving compliance with regulatory requirements, and adapting to regulatory changes through the deployment of AI technologies and AI solutions.

AI can assist compliance officers in identifying suspicious activity related to money laundering and anti-money laundering (AML) by automating compliance activities, thus reducing the workload and improving accuracy in compliance program management.

AI can mitigate false positives in compliance processes by analyzing large volumes of data and employing machine learning to distinguish genuine suspicious activity from erroneous alerts in AML and financial institutions.

Governance, Risk and Compliance Related Content

Enhance operational resilience using integrated risk management

MEGA HOPEX for GRC

Request a demonstration of HOPEX for GRC, and see how you can have immediate value of your projects.