Unlocking Transformation Success: The Crucial Role of Enterprise Architects in Merger-Acquisitions

During a merger or acquisition, financial considerations often take the spotlight. However, once the deal is sealed, the real transformation project begins, fraught with numerous pitfalls and involving multiples resources. To coordinate the entire project, including the transformation of information systems, process evolution, and compliance, the enterprise architect is the ideal candidate.

Mergers and acquisitions: a Human, Technological and Regulatory Project

In theory, a merger and acquisition (M&A) aims to consolidate the positions of the newly formed group. In practice, it's an extremely risky endeavor. Depending on the source, between 50 and 70%* of M&A end in failure: at best, the primary strategic objectives aren't met; at worst, a split is deemed necessary to preserve the viability of the two original companies

Why such a high failure rate? The challenges on the ground are numerous, notably because human factors, with all their complexity, are a critical component of any M&A operation: cultural diversity between the two companies, resistance to change within the teams, and more.

At the same time, the synchronization and even the rationalization of information systems and processes are far from straightforward, but are essential for the new entity’s smooth operation. These projects are typically lengthy and delicate to execute, with data migration and maintaining data quality being key challenges. Additionally, compliance issues cannot be overlooked, as the new entity must comply with the standards and regulations across all territories where it operates.

Prioritizing synchronization projects: the first post-merger task

Beyond the ongoing human aspects necessary for the operation’s success, the numerous challenges related to the system synchronization, process alignment, and new compliance imperatives require the establishing priorities. Contrary to common belief, these priorities are far from obvious.

We will naturally focus first on the critical processes of the organization (such as credit approval in a bank) and the supporting information systems, due to their significant financial or reputational impact. However, this initial prioritization must be balanced with other criteria related to the transformation project’s risks.

The obstacles can be numerous, often tied to the technical complexity of systems integration—such as risk of service interruption, operational disruptions, security incidents, or even cultural conflicts—all of which can severely impact the company’s revenue, costs, or reputation.

Among all considerations, regulatory compliance typically takes precedence, with the overarching objective of minimizing legal risks across all aspects of the organization's activities within its expanded scope.

The enterprise architect central to M&A success

The interdependence of process harmonization, team integration and system integration projects is essential to the success (or failure) of a merger-acquisition. Positioned at the crossroads of the company and equipped with a global vision, the enterprise architect has all the legitimacy to organize and lead post-merger projects.

Upstream, he will be able to understand the strategic objectives of the transformations, in agreement with the executive team, contributing to the development of an integration roadmap to ensure smooth change management.

During the merger-acquisition phase, much like in their traditional missions, the enterprise architect will first analyze the existing organizations of both companies, including their IT architectures, systems, data, and processes - then identify synergies and redundancies. Depending on the criticality of processes and components, integration priorities are then defined. Throughout this process, the enterprise architect prioritizes operational stability and designs a target architecture tailored to the newly merged entity, drawing upon best practices and emerging technologies.

More broadly, the enterprise architect demonstrates their full value as a coordinator in an M&A context. Alongside constant collaboration with IT teams, they organize and plan data migration with data teams (including data governance and data architects) To ensure data quality, integrity, and security. Similarly, close collaboration with Risk and Compliance teams will also ensure the new architecture strictly adheres to regulations and legal requirements.

In a merger-acquisition context, the enterprise architect acts as a true facilitator. They significantly mitigate the long-term risk of failure, that so often plagues merger and acquisition.

* Akoya Consulting 2019, Harvard Business Review, McKinsey

Enterprise Architecture Related Content

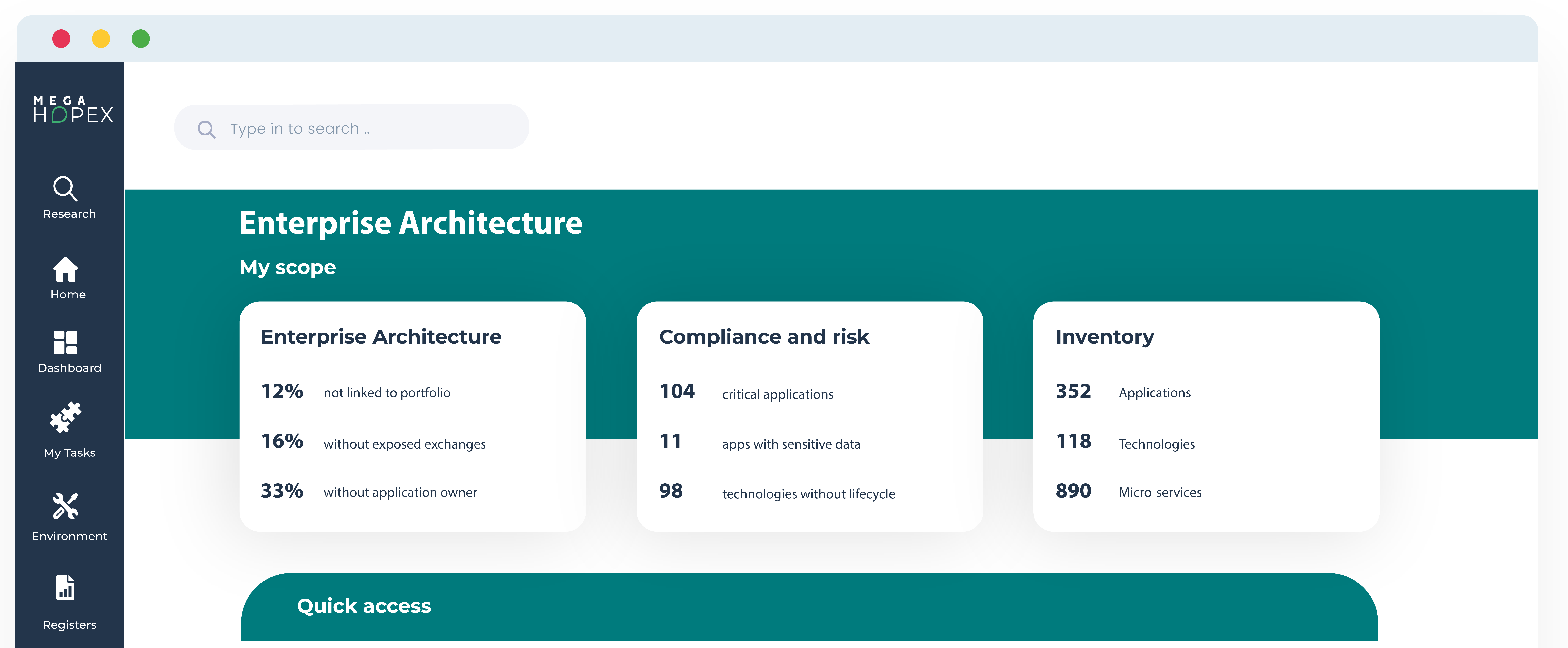

Shift from a documentation tool to an operational tool and accelerate business transformation

MEGA HOPEX for Enterprise Architecture

Request a demonstration of HOPEX for EA, and see how you can have immediate value of your projects.